Table of Contents

Imagine a world where your bank talks to your budgeting app, your investment platform syncs with your savings account, and your loan provider offers you personalized rates—all without you lifting a finger. Sounds futuristic, right? Well, that future is already here, thanks to open banking. By 2026, the open banking market is projected to hit a staggering $43 billion, and it’s not just a buzzword—it’s a full-blown revolution in how we manage our money. But what exactly does this mean for you, the consumer?

Open banking development has made it possible for people to gain financial control of their future with unprecedented authority. Users now have the power to handle their multiple banking accounts within one app interface while receiving customized loan opportunities based on their consumption patterns via immediate financial transfers without phone app changes. New opportunities unfold endlessly while the initial effect has only started. Let’s take a closer look at how open banking is transforming the financial ecosystem, and what it means for consumers and the financial industry alike.

What is Open Banking? 🏦

Open banking is like giving your financial data a passport to travel between different apps and services—but only with your permission. At its core, it’s a system that uses something called APIs (Application Programming Interfaces), which are basically digital bridges that let different software talk to each other securely. These APIs allow your bank to share your financial information—like your spending habits, account balances, and transaction history—with third-party providers, such as budgeting apps, investment platforms, or even other banks. But here’s the important part: none of this happens without your say-so. You’re always in control.

How does it work in practice? Let’s say you want to use a budgeting app to track your spending across multiple accounts. With open banking, you can grant that app access to your bank data through an API. The app then uses that information to give you insights, like where you’re overspending or how much you’re saving. And don’t worry—your data is shared securely, and you can revoke access anytime. In a nutshell, open banking is about giving you the power to share your financial data safely, so you can get smarter, more personalized services that make managing money easier.

So, how did open banking go from a niche idea to a global phenomenon? It all started with a push for more transparency and competition in the financial world. In Europe, the Payment Services Directive 2 (PSD2) kicked things into high gear by requiring banks to share customer data (with consent, of course) with authorized third-party providers. Think of it as forcing banks to play nice with fintech startups and other innovators.

Meanwhile, other regions weren’t far behind—the UK rolled out its own Open Banking Initiative, while countries like Australia, Brazil, and India introduced similar frameworks. These regulations didn’t just open the door for new players; they completely reshaped the financial landscape, putting consumers in the driver’s seat. And honestly, it’s about time!

Open Banking provides features previously unheard of in global financial markets , especially for people with little experience in this area. However, it also presents several benefits for fintechs and non-traditional financial organizations, which are worth knowing.

How Open Banking Works 🛠️

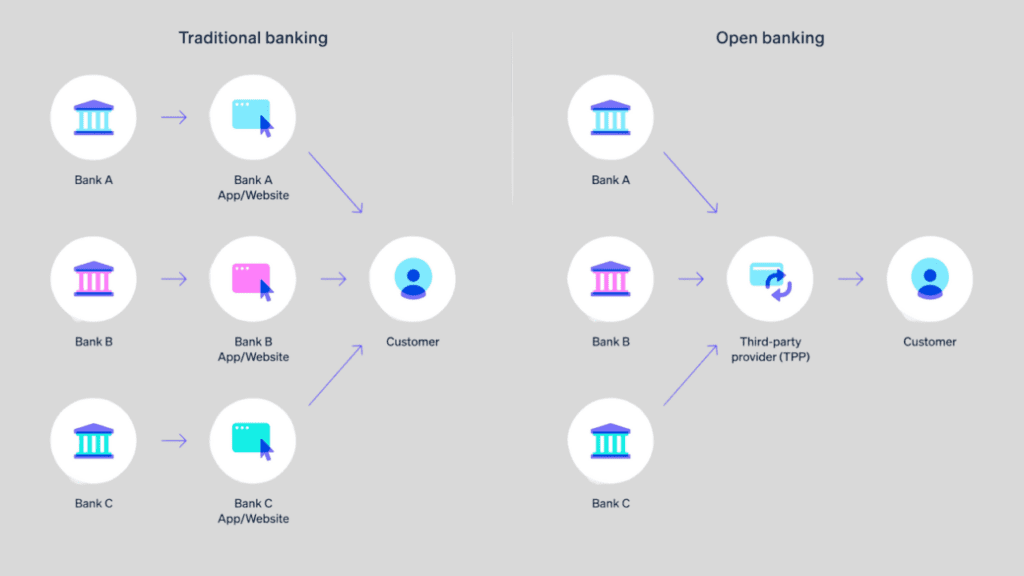

Open banking uses APIs to offer interoperable financial services. These APIs allow banks and approved third-party suppliers to securely communicate financial information. Unlike traditional banking services, which are frequently conducted in a closed setting, open banking decentralizes financial services.

In conventional banking, data is frequently compartmentalized within specific institutions, making it difficult for external apps to interface directly with financial accounts. Open banking upsets this by requiring standardised data formats and secure communication mechanisms. This establishes a fair playing field, allowing third-party services to interface with numerous banks using a common set of rules, regulations, and technological standards.

The APIs in open banking are typically categorized into three main types:

- Data APIs: These provide read-only access to account information, balances, and transaction history.

- Transaction APIs: These APIs allow for transferring funds, setting up direct debits, and initiating payments.

- Product APIs: These enable third parties to list financial products, rates, and terms. They’re often used for comparison websites or marketplaces.

Let’s get one thing straight: open banking isn’t about handing over your financial data to just anyone. It’s about you being in control. At the heart of open banking is the principle of consumer consent—meaning no one can access your financial information unless you explicitly say so. Think of it like giving a trusted friend a key to your house, but only for specific rooms and only when you’re okay with it.

This level of control is a game-changer, empowering you to decide who gets access to your data, for how long, and for what purpose. Whether it’s a budgeting app helping you save smarter or a loan provider offering you a better rate, the power is always in your hands. And if you change your mind? You can revoke access with just a few clicks. Now that’s what we call putting the consumer first!

Alright, let’s get practical—how does open banking actually work in real life? Imagine this: you’re shopping online, and instead of fumbling for your credit card, you simply choose “pay by bank” at checkout. That’s payment initiation services in action. Open banking allows you to authorize a direct payment from your bank account to the merchant, cutting out the middleman (and often the fees). It’s faster, cheaper, and way more secure. Companies like PayPal and Stripe are already leveraging this, making your online shopping experience smoother than ever.

Now, let’s talk about personal finance apps. Ever wished you could see all your accounts—checking, savings, credit cards, even investments—in one place? Apps like Mint, Yolt, or Emma do exactly that, thanks to open banking. By securely accessing your financial data (with your permission, of course), these apps give you a bird’s-eye view of your money. They can track your spending, set budgets, and even nudge you when you’re overspending on coffee. It’s like having a financial coach in your pocket.

And here’s one for anyone who’s ever struggled to get a loan: credit scoring systems. Traditional credit checks often leave out people with thin credit histories, like young adults or newcomers to a country. Open banking changes the game by allowing lenders to look at your actual financial behavior—like your income, spending habits, and savings—instead of just a credit score. Companies like Experian and ClearScore are using this data to offer fairer, more inclusive lending decisions. Suddenly, that dream car or home renovation feels a lot more within reach.

These are just a few examples, but they show how open banking isn’t just a techy concept—it’s making real, tangible differences in how we manage and interact with our money.

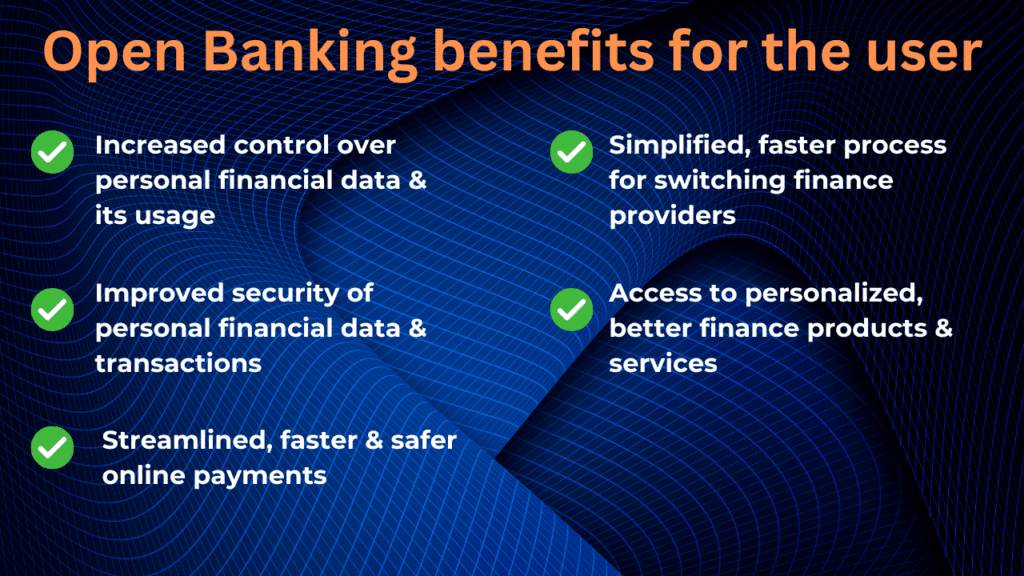

Key Benefits for Consumers 🎁

📌 Better Personalization

Let’s face it—we’re all unique, so why should our financial products feel like they were made for someone else? That’s where open banking comes in, acting like a financial tailor for the digital age. By giving fintech companies access to your financial data (with your permission, of course), open banking allows them to create products and services that fit your life like a glove.

Need a loan? Instead of a one-size-fits-all offer, you could get a customized loan with rates and terms that actually make sense for your income and spending habits. Or maybe you’re trying to save for a big goal—open banking-powered budgeting tools can analyze your cash flow and nudge you with personalized tips to stay on track.

Even investment advice gets a high-tech upgrade, with platforms using your financial data to recommend strategies that align with your goals and risk tolerance. In short, open banking is like having a financial advisor, loan officer, and budgeting coach rolled into one—except it’s all happening seamlessly in the background, just for you.

📌 Increased Competition and Choice

Let’s face it—traditional banking hasn’t always been known for putting customers first. But open banking is flipping the script by creating a more competitive and consumer-friendly financial ecosystem. How? By breaking the monopoly banks once had on your financial data. Now, with your permission, fintech companies, startups, and even non-bank players can access your financial information to offer you better, faster, and cheaper services. Imagine shopping around for a loan and getting personalized rates in seconds, or switching to a budgeting app that actually understands your spending habits. That’s the power of open banking—it’s like giving you a financial marketplace where you’re the VIP.

And here’s the kicker: this competition isn’t just about saving you money (though that’s a big plus). It’s about giving you real choice. Whether you’re looking for a high-yield savings account, a flexible mortgage, or an app that helps you invest spare change, open banking means you’re no longer stuck with whatever your bank decides to offer. Instead, you get to pick the services that actually work for you. It’s like upgrading from a one-size-fits-all approach to a tailor-made financial wardrobe. And who doesn’t love having options?

📌 Enhanced Convenience

Let’s be real—managing money can feel like a chore. Between juggling multiple bank accounts, tracking expenses, and making payments, it’s easy to feel overwhelmed. But what if I told you open banking is here to make your financial life way easier? Picture this: instead of logging into three different apps to check your accounts, you can see everything in one place—thanks to open banking. Need to split a dinner bill with friends? No more awkward “I’ll pay you back later” texts. With open banking-powered apps, you can send money instantly, right from your phone. And those tedious money transfers that used to take days? Now they happen in seconds.

But it doesn’t stop there. Open banking is like having a personal financial assistant that works 24/7. Want to automate your savings? Done. Need to track your spending habits? Easy. Even managing subscriptions or paying bills has become a breeze. By connecting your accounts to smart apps and platforms, open banking turns complicated financial tasks into simple, seamless actions. It’s all about saving you time, reducing stress, and making your money work smarter—not harder.

📌 Improved Financial Inclusion

Let’s talk about one of the coolest things open banking is doing: leveling the playing field for underserved populations. For far too long, millions of people—like those without a traditional credit history or steady income—have been locked out of the financial system. But open banking is changing that. By allowing lenders to access a person’s financial data (with their permission, of course), open banking enables alternative credit scoring.

Think about it: instead of relying solely on a credit score, lenders can now look at your actual spending habits, bill payments, and even cash flow to assess your creditworthiness. This means someone who’s been financially responsible but doesn’t have a credit card or loan history can finally get a fair shot at a loan or mortgage. And it’s not just about loans—open banking is also paving the way for microloans, flexible payment plans, and other financial tools tailored to people who’ve been overlooked by traditional banks. It’s like giving everyone a seat at the financial table, and honestly, it’s about time.

How Open Banking is Changing the Financial Landscape 💰

Traditional banks have had it pretty comfortable for a long time. They held all the cards (and the data), and consumers didn’t have much choice but to play by their rules. Enter open banking, and suddenly, the game has changed. Traditional banks are now under pressure to step up their game. No longer can they rely on being the only option in town. With open banking, they’re being forced to innovate, improve their digital offerings, and focus on customer experience like never before. Think better apps, faster services, and more personalized products. It’s survival of the fittest, and banks are finally realizing they need to evolve—or risk being left behind.

But while banks are scrambling to adapt, fintech companies are having a field day. Open banking has leveled the playing field, allowing these agile, tech-savvy startups to thrive. From budgeting apps that sync all your accounts in one place to platforms that offer lightning-fast loans based on your financial data, fintechs are delivering the kind of digital-first solutions that today’s consumers crave. And here’s the twist: instead of just competing, many banks and fintechs are now joining forces.

Think of it as a financial ecosystem where everyone wins. Banks bring the trust and infrastructure, fintechs bring the innovation, and together, they’re creating services that are better, faster, and more customer-friendly. Take, for example, partnerships like BBVA teaming up with fintechs for seamless payment solutions or Goldman Sachs collaborating with startups to offer digital banking services. It’s a brave new world, and collaboration is the name of the game.

Challenges and Considerations 🚧

🛡️ Data Privacy and Security

Now, let’s address the elephant in the room: data privacy and security. Sharing your financial data with third parties might sound a little scary—after all, your money and personal information are on the line. And you’re not wrong to feel that way. With open banking, your data is shared through secure APIs (think of them as digital handshakes), but that doesn’t mean risks don’t exist.

What if a third-party app gets hacked? Or what if your data ends up in the wrong hands? These are valid concerns, and they’re exactly why regulators have stepped in with strict rules. For example, under PSD2 in Europe, third-party providers must meet rigorous security standards and get explicit consent from you before accessing your data. Plus, they can only use it for the specific purpose you’ve agreed to—no sneaky side deals.

But here’s the thing: while the system is designed to be secure, it’s not foolproof. That’s why it’s crucial for you, the consumer, to stay vigilant. Always check the credibility of the apps or services you’re connecting to, read the fine print, and keep an eye on your accounts for any unusual activity. At the end of the day, open banking is about giving you control—but with great power comes great responsibility. So, stay informed, stay cautious, and you’ll be in a much better position to enjoy the benefits without the headaches.

📋 Regulatory Challenges

Now, let’s talk about the not-so-glamorous side of open banking: regulatory hurdles. While the idea of sharing financial data sounds great in theory, making it work across different regions is like trying to solve a giant puzzle where every piece is shaped differently. Take Europe, for example—PSD2 set the gold standard for open banking, creating a unified framework that made it easier for fintechs and banks to collaborate. But hop over to the US, and it’s a whole different story.

Instead of one sweeping regulation, the US has a patchwork of state and federal rules, which can make things, well, complicated. And don’t even get me started on regions like Asia or Africa, where some countries are racing ahead with innovative policies, while others are still figuring out where to start.

These regulatory differences aren’t just a headache for businesses—they can also slow down the global rollout of open banking benefits for consumers. For instance, a fintech company might have to jump through entirely different hoops to operate in Europe versus the US, which can limit the services available to you. And then there’s the ever-present challenge of balancing innovation with security. Regulators want to protect your data, but too many restrictions can stifle the very creativity that makes open banking so exciting. It’s a tightrope walk, and finding the right balance is key to making open banking work for everyone.

📈 Adoption Barriers

Not everyone is rushing to jump on the open banking bandwagon. For some consumers, the idea of sharing their financial data with third-party apps can feel a bit, well, risky. After all, we’ve all heard those horror stories about data breaches and identity theft. Building trust is a huge hurdle, and it’s going to take time—and a lot of transparency—to convince people that their money and personal info are safe in this new system.

And let’s not forget, not everyone is a tech wizard. For many, the whole concept of APIs and data sharing might as well be rocket science. Educating users about how open banking works and why it’s beneficial is a massive challenge, but it’s absolutely crucial for widespread adoption.

On the flip side, traditional banks aren’t exactly rolling out the red carpet either. For decades, they’ve had a monopoly on customer data, and suddenly being told to share it? Yeah, that’s a tough pill to swallow. Some banks are dragging their feet, worried about losing their competitive edge or struggling to modernize their outdated systems. Plus, there’s the whole issue of navigating complex regulations, which can feel like trying to solve a Rubik’s Cube blindfolded. But here’s the thing: open banking isn’t going away. The sooner banks and consumers get on board, the better—because, like it or not, the future of finance is open.

The Future of Open Banking in Consumer Financial Services 🌱

The growth of open banking is far from slowing down—in fact, it’s just getting started. While Europe and the UK have been the trailblazers, emerging markets are now catching the wave. Countries in Asia, Africa, and Latin America are beginning to embrace open banking, and the potential is huge. Imagine millions of people gaining access to financial services for the first time, thanks to open banking-powered solutions like microloans, digital wallets, and alternative credit scoring. It’s not just about convenience; it’s about financial inclusion on a global scale. And as more countries roll out supportive regulations, the open banking ecosystem is set to become a truly worldwide movement, reshaping how money moves and empowering consumers everywhere.

But what’s really exciting is how technology is supercharging open banking. Think about it: AI and machine learning are making financial advice smarter and more personalized, while blockchain is adding layers of security and transparency to transactions. These advancements aren’t just cool tech—they’re making open banking services faster, safer, and more intuitive for consumers. And let’s not forget fintech innovation! From seamless payment platforms to AI-driven wealth management tools, open banking is fueling a wave of creativity in payments, lending, insurance, and beyond. The result? A financial ecosystem that’s not only more connected but also more innovative and consumer-friendly than ever before.

FAQ 💡

What is open banking, and how does it work?

Open banking is a system that allows third-party financial service providers to access consumer banking data through APIs (Application Programming Interfaces), with the consumer’s consent. It enables seamless sharing of financial information between banks and authorized apps or services, fostering innovation and improving consumer experiences.

How does open banking benefit consumers?

Open banking empowers consumers by providing greater financial transparency, personalized products, and improved accessibility. It allows users to manage their finances more effectively, access better deals, and enjoy seamless payment experiences.

Is open banking safe and secure?

Yes, open banking is designed with strong security measures, including encryption and strict regulatory requirements. Consumers must give explicit consent for their data to be shared, and they can revoke access at any time.

Which countries are leading in open banking adoption?

Europe and the UK have been pioneers, thanks to regulations like PSD2 and the Open Banking Initiative. However, countries like Australia, Brazil, India, and parts of Africa are rapidly catching up, with emerging markets showing significant potential.

How does open banking promote financial inclusion?

Open banking enables underserved populations, such as those without traditional credit histories, to access financial services. By leveraging alternative data sources, it allows for microloans, digital wallets, and innovative credit scoring methods.

What role do fintech companies play in open banking?

Fintech companies are at the forefront of open banking innovation. They use open banking APIs to create personalized financial products, such as budgeting apps, investment platforms, and payment solutions, enhancing the consumer experience.

How is open banking transforming payments?

Open banking is revolutionizing payments by enabling faster, cheaper, and more secure transactions. Account-to-account payments, for example, eliminate intermediaries, reducing costs and processing times.

What are the challenges of open banking?

Challenges include data privacy concerns, regulatory inconsistencies across regions, and the need to build consumer trust. Educating users about the benefits and risks of open banking is also crucial for widespread adoption.

How will technologies like AI and blockchain enhance open banking?

AI and machine learning can provide personalized financial insights and recommendations, while blockchain can enhance security and transparency. These technologies will make open banking services smarter, safer, and more efficient.

What does the future of open banking look like?

The future of open banking is bright, with global expansion, increased innovation, and deeper integration with emerging technologies. It will likely evolve into “open finance,” where even more financial data and services are interconnected, creating a more inclusive and consumer-centric financial ecosystem.

References

- https://www.ukfinance.org.uk/policy-and-guidance/guidance/payment-services-directive-2-and-open-banking

- https://www.ecb.europa.eu/press/intro/mip-online/2018/html/1803_revisedpsd.en.html

- https://www.openbanking.org.uk/

- https://en.wikipedia.org/wiki/Open_banking

- https://www.canada.ca/en/financial-consumer-agency/services/banking/open-banking.html