Table of Contents

What are Central Bank Digital Currencies (CBDCs)? 💲

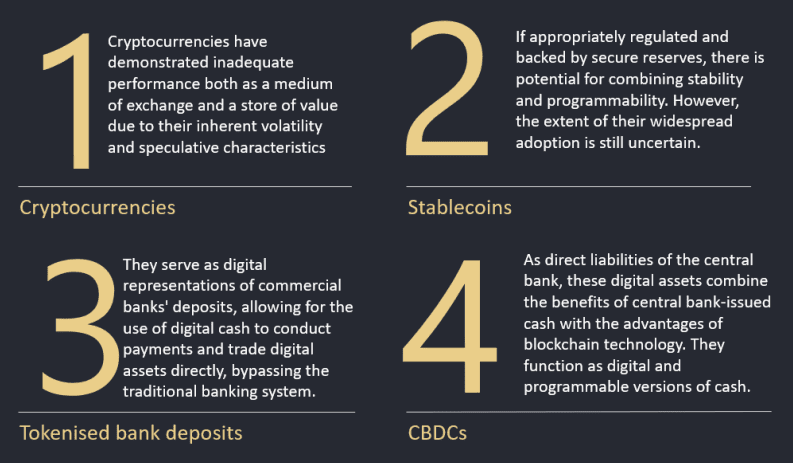

Central bank digital currencies (CBDC) is a type of digital money created by a country’s central bank. It is comparable to cryptocurrencies, but its value is set by the central bank and is equal to the country’s fiat currency.

When was the last time you paid for something in cash? While physical currency is still extensively used around the world, people in some nations have been utilising it far less recently. As consumers abandon cash, they are increasingly resorting to digital financial transactions. Globally, banks and financial institutions handle considerably more transactions digitally than in physical branches.

Many countries are developing Central bank digital currencies’, and some have already implemented them. Because so many countries are exploring ways to transition to digital currencies, it is critical to understand Central bank digital currencies and their implications for society.

Central bank digital currencies are related to, but not identical to, stablecoins. Stablecoins are a sort of private, stabilised cryptocurrency that is tied to another currency, commodity, or financial instrument in order to keep its value reasonably stable over time. Central bank digital currencies are issued and operated by the state, as opposed to decentralised cryptocurrencies.

Key Takeaways

- Issued and governed by a country’s central bank

- Traditional money, but in digital form

- Influenced in terms of supply and value by a country’s monetary policies, trade surpluses and central bank

- Not a Cryptocurrency (like Bitcoin) governed by distributed autonomous communities instead of a centralised body

- Not equivalent to electronic cash (e.g., balance in a digital wallet or a prepaid card) with claim against an intermediary such as a commercial bank.

Key drivers for CBDC adoption 🗝️

In the United States and many other countries, many people lack access to financial services. In the United States alone, 6% of persons had no bank account by 2023.In several other countries, the numbers are significantly greater.

Cash usage is falling sharply. Cash usage in Europe fell by one-third between 2014 and 2021. In Norway, barely 3% of payment transactions are performed in cash. This tendency has prompted central banks to reconsider their position in the monetary system.

There is a growing interest in privately issued digital assets. In the United Kingdom, 10% of adults report owning or having held a digital asset, such as cryptocurrency. According to the European Central Bank, up to ten percent of households in six main EU nations possess digital assets. Consumer use of digital assets has the potential to undermine fiat currency as a unit of value measurement.

Central banks are losing their reputation as payment pioneers. Central bank digital currencies provide central banks with a unique opportunity to conduct strategic discussions about cash use cases in a public arena.

Overall, Central bank digital currencies would strengthen the payments environment by promoting competition, efficiency, regulation, and innovation. They would also address the decline in cash usage by increasing the usability and availability of real central bank money.

Design considerations for CBDCs 🎭

Central banks throughout the world are evaluating several CBDC designs while considering concerns such as access, privacy, and distribution mechanism. Central bank digital currencies have two widespread design formats: token-based and account-based. Each method has an own technological infrastructure, as well as different levels of access and privacy.

Token-based CBDC

Token-based Central bank digital currencies make use of a digital token, and users must be familiar with it in order to access or make claims. This system normally provides a high level of anonymity; but, central banks may impose identity restrictions to access the network. Token transfers rely on the sender’s capacity to confirm the legitimacy of the payment object, necessitating the use of distributed ledger technology to verify the chain of ownership in each token and validate payment transactions. This also increases the end-user risk of losing a key or token stored in a noncustodial wallet.

Commercial banks would be the first line of defence for compliance with know-your-customer (KYC) and anti-money laundering/counter-terrorism financing (AML/CFT) rules under a token-based strategy. This strategy can enable ubiquitous access to CBDCs, but it also complicates law enforcement when compared to alternative systems.

Account-based CBDCs

Account-based CBDC access and claims are connected to a bank account associated with the account holder’s identification. This strategy presents a challenge for widespread access because it still requires a banking link. To transfer funds, banks would debit the sender’s CBDC account and credit the recipient’s CBDC account. Transactions must be confirmed using user IDs, hence strong identity management systems are essential to retain a unique identification for each individual across payment systems.

In an account-based model, the central bank is responsible for ensuring KYC and AML/CFT compliance. Transfer verification in an account-based system is dependent on putting sufficient controls in place to prevent identity theft, fraud, and unauthorised transfers from legitimate accounts.

Many design factors, including as distribution, access, and privacy, must be carefully examined while determining the best CBDC implementation. A central bank can identify the optimum method by reviewing the lessons learnt from previous CBDC and cryptocurrency systems, as well as the anticipated advantages and trade-offs.

Types of CBDCs 🎲

There are two types of Central bank digital currencies: wholesale and retail. Financial institutions are the primary users of wholesale CBDCs, whereas consumers and businesses use retail CBDCs.

| Domestic | Cross-border | |

| Retail | Financial and non-financial users could hold accounts of digitized central bank money | Foreign financial and non-financial users could hold accounts of digitized central bank money |

| Wholesale | Akin to electronic central bank reserves | Foreign financial institutions could hold accounts of digitized central bank money |

Retail CBDCs

Retail Central bank digital currencies are government-backed digital currencies used by both consumers and businesses. Retail CBDCs minimise intermediary risk—the chance that private digital currency issuers would go bankrupt and lose their consumers’ funds.

Retail Central bank digital currencies are being explored most prominently. They are already in use in several countries, including the Bahamas, Jamaica, Nigeria and the Eastern Caribbean.

In 2019, the Bahamas implemented its first retail CBDC. The Sand Dollar is tied to the US dollar and is meant to increase financial access for the Bahamas’ 18% unbanked population, as well as the resilience of the country’s payment infrastructure.

As we discussed above retail Central bank digital currencies can be implement in Token based or Account based.

Wholesale CBDCs

Wholesale Central bank digital currencies work similarly to a central bank’s reserves. The central bank opens an account in which an institution can deposit cash or settle interbank payments. Central banks can then utilise monetary policy measures, such as reserve requirements or interest on reserve balances, to set interest rates and control lending.

This would be a form of central bank money that would be perfectly fungible with reserves, accessible only to a limited set of economic agents (at least those who currently have access to reserves, i.e. banks), and available in a distributed ledger technology (DLT) environment. These features distinguish wholesale Central bank digital currencies both from retail central bank digital currency ,which is accessible to the general public and is not necessarily supported by DLT, and from reserves, which are accessible only to banks, but not supported by DLT.

Impact of CBDCs on commercial banks 🏦

Commercial banks are strongly focused on customer-facing operations, secure transactions, and regulatory reporting, and they have been handed CBDC design decisions, making them crucial partners in effectively implementing a CBDC. Central bank digital currencies bring an electronic version of central bank money, adding substantial complexity to commercial banks and perhaps requiring a severe transformation across the company to stay up with the requirement to invent suitable products.

As central banks begin on the digital currency journey with CBDCs, the domestic and global economies may see a paradigm shift. While much remains to be resolved, the architecture of a CBDC will have far-reaching repercussions for the financial sector.

Potential Benefits of CBDCs ✅

Let’s take a look at the advantages of Central bank digital currencies and how you can leverage them.

Ease of Transactions

One of the primary CBDC benefits is the ease and speed of transactions. Whether you’re buying for goods and services, transferring money to friends and family, or receiving payments, e₹ offers quick and easy transactions.

Better payment efficiency and accessibility

Central bank digital currencies can enable immediate transactions, significantly reducing the time and cost involved with cross-border payments. This efficiency eliminates the need for traditional middlemen such as banks or payment processors, enabling a more streamlined, secure, and efficient method of completing transactions.

Heightened security and transparency

CBDCs can provide enhanced security and transparency. They are well-prepared to tackle fraud and cyber threats because to their strong encryption and authentication methods. Furthermore, the transparency of CBDCs assures a detailed record of transactions, assisting in the prevention of money laundering and other illegal acts.

Minimising cash handling risks

CBDC benefits include reduced expenses and dangers associated with handling real currency. CBDC has the ability to reduce expenditures and security threats by eliminating the need for currency handling and transit. They also serve an important role in combating counterfeiting and theft, two major problems with actual cash.

Offline availability

Another possible advantage of CBDC is that it might function in situations where there is no internet access, such as an underground parking lot, a flight, or a metro. Simply place your phone close to the payment terminal at the merchant business and make the payment. This functionality may be supported by Near Field Communications (NFC) or Bluetooth technology.

Ability to programme CBDCs for specific purposes

CBDC has supplied programming options that are tied to a certain end-use. For example, if an individual obtains credit from a bank solely for agricultural reasons, the digital currency can be coded to ensure that the credit is exclusively used for agricultural purposes. This can help to address the issue of fund diversion while also facilitating financial inclusion for MSMEs. An business may issue programmable CBDCs to its personnel. This allows workers to utilise Central bank digital currencies to make payments for certain reasons and at specific places.

Strengthening financial inclusion

Another key advantage of Central Bank Digital Currency is its ability to increase financial inclusion. For many people who do not have access to traditional banking services, Central bank digital currencies can provide a dependable, safe, and cost-effective way to hold and move money. This feature is especially useful in areas with inadequate banking and internet access, minimizing reliance on physical currency. You may also transact with CBDC without using the internet.

Risks and Challenges 🛡️

Privacy: Digital currency may reduce the anonymity of transactions. Central bank digital currencies have the ability to allow governments and central banks to follow all user transactions, raising concerns about data confidentiality.

Data Security: Centralized CBDC databases may become targets for hackers, putting consumers’ financial security at risk.

Technological Exclusion: Not all citizens have access to digital technology, which may result in financial isolation for certain parts of the community.

Changes in Banking: Central bank digital currencies have the potential to disrupt established banking structures, diminishing banks’ role as middlemen and complicating loan availability.

Digital Inflation: If CBDC issuance is not carefully regulated, it may result in further inflationary pressure.

Monetary Policy Changes: Central bank digital currencies may give central banks with new economic influence instruments, which may be employed irrationally or result in higher volatility.

Risk of Skill Obsolescence: The transition to digital money may make particular professions obsolete, resulting in employment losses for specific parts of the population.

Inequality in Access to Information: The information gap may widen, with more wealthy groups having greater access to Central bank digital currencies information and education.

Transition Complexity: For many consumers, switching to digital money may be technically difficult, causing them to be hesitant to accept this innovation.

Dependence on Technology: Complete dependence on electronic systems for the financial system might have disastrous consequences in the case of technical breakdowns or cyber-attacks.

CBDCs vs. Cryptocurrencies 🪙

The cryptocurrency ecosystem provides a glimpse of an alternative currency system in which cumbersome regulations don’t dictate the terms of each transaction. These transactions are difficult to copy or counterfeit, and they are protected by consensus methods that prohibit manipulation.

Furthermore, cryptocurrency is uncontrolled and decentralised. Their value is determined by investor opinion, use, and user interest. They are volatile assets better suited to speculation, making them odd candidates for use in a financial system that demands stability. Central bank digital currencies reflect the value of fiat currency and are intended to provide stability and security.

Insights from Global Developments 🌎

Has Any Country Launched a CBDC? Yes, Jamaica, Nigeria, and The Bahamas have launched CBDCs.

At present, more than 100 countries representing more than 90 percent of global GDP—are exploring CBDCs.Have a look at global CBDC developments.

Though countries like China, Sweden, Canada and the United Kingdom have led research and pilot projects in the past few years, the actual execution of CBDC pilots is being led by smaller nations.

Nigeria, the first African country to roll out a CBDC, launched eNaira in October 2021.

In late 2020, the Central Bank of the Bahamas introduced the Sand Dollar, a digital currency backed by the country’s central bank. The Sand Dollar has simplified monetary transactions over an otherwise extensive archipelago. It also aims to increase transaction efficiency, service delivery costs, and financial inclusion.

Jamaica’s JAM-DEX launched in June 2022 and is the first CBDC to be ratified formally as legal tender. It’s a relatively simple offering, with no advanced use cases such as cross-border payment for smart contracts. JAM-DEX isn’t blockchain based, unlike the Bahamas’ Sand Dollar.

In Sweden, the creation of the e-krona demonstrates the significance of a human-centered design approach. The Swedish central bank collaborated with UX designers and conducted comprehensive surveys to customise the digital currency to residents’ different demands, ranging from tech-savvy folks to those unfamiliar with digital financial services. This strategic decision resulted in a more accessible and user-friendly CBDC, improving usability.

Singapore‘s Project Ubin demonstrates the benefits of regulatory sandboxes and diversified skills. Singapore’s Monetary Authority investigated the possible influence of CBDC infrastructure on user behaviour and adoption through controlled testing, with an emphasis on behavioural economics.

These real-world examples highlight the significance of a comprehensive strategy that includes human-centered design, regulatory innovation, collaboration with financial players, and proactive public engagement in the effort to create CBDCs that actually promote financial inclusion. Each option has ramifications for the use, acceptance, and overall effectiveness of CBDCs in creating inclusive finance systems.

Future of Central bank digital currencies 🌱

Today, momentum is building around Central bank digital currencies. There are 150 CBDC trials taking place worldwide (at either launch, pilot, proof of concept or research stage). Meanwhile Research predicts the value of payments via Central bank digital currencies will reach $213 billion a year by 2030, up from just $100 million in 2023.

Still, the introduction of digital currencies raises questions. There are issues of privacy and inclusion, user interface and design. There is also the challenge of making offline CBDC payments reliable, safe and available to all citizens.

- Countries representing 98 percent of global GDP, are exploring a CBDC.

- There are currently 12 cross-border wholesale CBDC projects.

- More than 20 countries took steps towards piloting their CBDCs in 2023.

- 19 of the G20 countries are now in the advanced stage of CBDC development. Of those, nine countries are already in pilot.

- China’s pilot, which currently reaches 260 million people, is being tested in over 200 scenarios.

As the globe actively investigates and evaluates the CBDC idea, it is critical to be alert to possible hazards and threats. Clearly, the deployment of digital currencies may have far-reaching negative implications if sufficient regulation, security safeguards, and human rights protection are not in place. Central bank digital currencies may deliver enormous advantages while minimizing dangers to the economy and the common person if implemented correctly, which involves the creation of strong protections and clear regulatory frameworks.

FAQ 💡

What is a Central Bank Digital Currency (CBDC)?

A Central Bank Digital Currency (CBDC) is a digital form of a country’s fiat currency issued and regulated by the central bank. Unlike cryptocurrencies, CBDCs are centralized and aim to provide a secure, efficient, and government-backed alternative to physical cash.

How do CBDCs differ from cryptocurrencies like Bitcoin?

CBDCs are issued and controlled by central banks, making them centralized and regulated. In contrast, cryptocurrencies like Bitcoin are decentralized, operate on blockchain technology, and are not backed by any government or central authority.

What are the benefits of Central Bank Digital Currencies?

CBDCs offer several advantages, including faster and cheaper transactions, enhanced financial inclusion, reduced fraud, and improved monetary policy implementation. They also provide a secure digital alternative to physical cash in an increasingly cashless society.

Which countries are leading in CBDC development?

Countries like China (with its digital yuan), Sweden (e-krona), and the Bahamas (Sand Dollar) are at the forefront of CBDC development. Many other nations, including the US, EU, and India, are actively researching or piloting their own digital currencies.

What are the potential risks of CBDCs?

While CBDCs offer numerous benefits, they also pose risks such as privacy concerns, cybersecurity threats, and the potential for central banks to monitor and control financial transactions. Balancing innovation with security and privacy remains a key challenge.

How will CBDCs impact the future of money and banking?

CBDCs are poised to redefine the future of money by transforming payment systems, reducing reliance on physical cash, and enabling more efficient cross-border transactions. They could also disrupt traditional banking by allowing individuals to hold accounts directly with central banks.

References 🔗

- https://www.weforum.org/whitepapers/central-bank-digital-currency-policy-maker-toolkit

- https://www.ecb.europa.eu/paym/digital_euro/html/index.en.html

- https://www.federalreserve.gov/cbdc.htm

- https://www.imf.org/en/Publications/fintech-notes/Issues/2021/07/12/The-Rise-of-Digital-Money-460468

- https://www.bis.org/topics/fintech/cbdc.htm