Table of Contents

Think about the last time you shopped online. You added an item to your cart, paid in one click, and maybe even split the payment into easy parts. You didn’t open a banking app or visit a lender. That smooth payment came from something called embedded finance.

Imagine buying a coffee. You open your favorite coffee shop’s app. You order your drink. Then, the app offers you a small loan to pay for it. You get your coffee and a tiny payment plan. You never see a bank’s name.

This is embedded finance. It means putting financial tools into places you already shop and use. Banking is fading into the background. It is becoming a simple feature, not a separate trip.

Embedded finance means adding banking or payment tools inside apps and websites people already use. It turns simple apps into money tools. You can borrow, pay, or insure something without ever visiting a bank.

This trend is changing how people use money every day. Retailers now offer “buy now, pay later.” Ride-share drivers can get paid instantly. Online stores give small loans to sellers. These services feel natural to users because they live right inside the apps they trust.

Businesses love this too. They can offer more value, keep customers longer, and open new income streams. Instead of sending users to a bank, they bring financial services directly to them. It’s fast, simple, and personal.

This shift is huge. It turns every business into a potential fintech. A retail store can offer credit. A software company can provide insurance. The lines between industries are blurring.

Behind the scenes, fintech providers make all this possible. They build the tech—like APIs and digital payment systems—that plug into business apps. It’s like adding a money engine under the hood of every platform.

This article will show you how it works. We will explore the main types of embedded finance. We will look at the real benefits for companies. We will also discuss the challenges. Finally, we will see what the future holds.

What is Embedded Finance? Defining the Invisible Revolution 💰

Embedded finance is when financial tools live inside non-financial apps or services. In short, it’s when you can pay, borrow, or insure without leaving the app you’re using.

Think of it like a toy in a cereal box. You buy the cereal for the food. The toy is a bonus inside. Similarly, you use an app for shopping or rides. A financial tool, like a loan, is the bonus feature.

You’ve seen it in action already. When you book a ride and pay inside the app, that’s embedded finance. When you buy something online and pick “pay later,” that’s it again. Even tipping a driver through an app counts.

This is different from open banking. Open banking is about sharing your data safely. Embedded finance uses that sharing to create new services. It turns non-banks into money service providers.

The key idea is convenience. People don’t want to jump between apps to manage money. They want everything in one place. Businesses noticed this and started adding finance features right where users already spend time.

So why does this matter? Because it changes how both people and companies handle money. For users, it saves time and feels easy. For businesses, it builds trust and keeps customers coming back. They don’t just sell products—they also help customers manage payments, credit, or risk.

Embedded finance makes money movement simple, fast, and built into the flow of life. And this change is only getting started.

The Core Models: How Businesses Are Embedding Finance 🏪

Embedded payments are the most common type. You see this every day. It is the one-click checkout on your favorite website. It is the stored credit card in your food delivery app. The goal is simple. Remove all friction from the act of paying.

Embedded lending is another huge area. “Buy Now, Pay Later” is the star here. You see it at online stores and even in physical shops. It splits a large cost into small, manageable payments. This makes expensive items feel more affordable. For businesses, it boosts the average order value. People simply buy more when they can pay later. Beyond shopping carts, embedded lending also helps small businesses. A platform like Shopify can offer a merchant a cash advance. This helps the shop owner buy more stock or run ads.

Embedded insurance is all about timing. It offers you protection at the exact moment you need it. Imagine you just bought a new laptop. The website immediately asks if you want to cover it for accidents. This is far more effective than selling insurance weeks later. The context is clear. The need is fresh. This works for travel, electronics, and even rental cars. The company earns a commission. The customer gets peace of mind without any extra effort.

Embedded wealth and investment is a newer field. It brings tools for growing money into everyday apps. Your banking app might let you invest spare change from your purchases. A financial app might offer you a way to buy bits of stocks. This makes investing feel less intimidating. It opens the door for people who are new to the stock market. The business gets a new service to offer. The customer gets a simple way to start building their future.

Together, these models show a clear path. Finance is no longer a separate chore. It is becoming a natural, helpful part of how we interact with the brands we love.

The Core Technologies Powering Embedded Finance 📲

Embedded finance sounds simple on the surface, but it runs on strong tech behind the scenes. These tools connect banks, apps, and users in ways that feel instant and smooth.

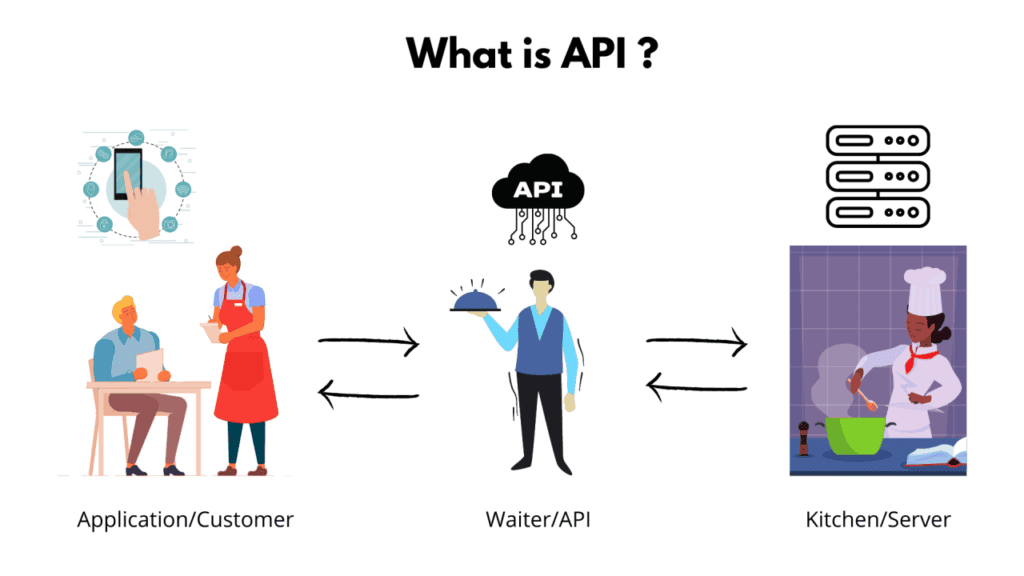

The main engine here is the API, short for application programming interface. APIs let apps talk to each other. They carry payment info, approve transactions, and check account details in seconds. Without APIs, you couldn’t pay through a shopping app or send money in a chat app.

Then there’s cloud computing. It gives businesses the power to run secure financial systems without owning big servers. Cloud platforms store and protect data while keeping everything quick and reliable.

Open banking is another key piece. It allows trusted apps to use your financial data safely—only with your permission. This helps apps offer custom loans, credit scores, or payment options that fit your habits.

Artificial intelligence (AI) also plays a big part. It helps companies spot fraud, make smarter lending choices, and offer personal finance tips. For example, AI can predict when a user might need a small loan or remind them about payments.

And then comes blockchain. It adds transparency and cuts out middlemen in some payment systems. It’s not used everywhere yet, but it’s growing fast in digital lending and cross-border payments.

Big fintech providers like Stripe, Plaid, and Adyen use all these tools to build plug-and-play systems. Businesses just connect to these platforms instead of building their own banks.

Together, these technologies make embedded finance fast, safe, and easy to scale—so any company can add finance features with a few lines of code.

Key Benefits of Embedded Finance for Businesses

For most companies, embedded finance isn’t just a nice add-on. It’s a smart move that helps them grow, keep customers, and stand out from the crowd.

Better customer experience.

People like it when things are simple. When payments, loans, or insurance happen inside the same app, users don’t have to leave or fill in long forms. That ease builds trust and keeps them coming back.

More revenue streams.

Every financial feature can bring new income. A store that offers “buy now, pay later” earns from interest or fees. A platform that processes payments earns a cut from each transaction. These small gains add up fast.

Stronger customer loyalty.

When users handle both shopping and finance in one place, they stick around longer. It feels natural and personal. The brand becomes part of their daily routine, not just a one-time stop.

Useful financial insights.

With built-in finance tools, companies learn more about user behavior. They can see how people spend, save, or borrow. That data helps create better offers and smarter business plans.

Less friction, faster growth.

Instead of building a whole banking system, companies connect through APIs from fintech providers. This saves time, reduces risk, and helps them launch faster.

No need for a banking license.

Businesses can offer financial tools without becoming banks themselves. They just partner with licensed fintech firms that handle the heavy work in the background.

Finally, the data collected is pure gold. Seeing how customers use money provides deep insights. You learn what they need and when they need it. This allows for hyper-personalized offers that feel helpful, not intrusive. You’re not just selling products anymore. You’re building a deeper, more understanding relationship with every customer.

In short, embedded finance helps companies offer more value with less effort. It’s a win for both sides—businesses make more money, and customers get a smoother experience.

The Role of Fintech Enablers and Platforms 🍎

Most businesses can’t build banking systems on their own. They don’t have the licenses, staff, or tech for it. That’s where fintech enablers come in. They provide the tools and platforms that make embedded finance possible.

These companies offer Banking-as-a-Service (BaaS). It’s like renting a ready-made bank system. Businesses plug in, connect through APIs, and start offering payments, cards, or loans without building anything from scratch.

Platforms such as Stripe, Marqeta, Solarisbank, and Railsr are leading the way. They give companies simple access to complex financial networks. A small app can now offer credit or payments with the same power as a big bank.

Here’s how it works:

- The fintech platform handles the hard stuff—regulations, security, and compliance.

- The business focuses on user experience and customer needs.

- APIs link them together so data and payments flow safely between both sides.

This partnership model saves time and cuts costs. It also opens doors for smaller companies that want to offer finance tools but can’t afford to build them.

Most of these platforms are modular. That means businesses can pick what they need—payments, lending, insurance, or cards—and add more later. This flexibility makes it easy to grow.

In short, fintech enablers act like the hidden engines behind the apps we use every day. They make sure money moves fast, safe, and in the background—while users just see a clean, simple experience.

Challenges and Risks in Implementing Embedded Finance

Embedded finance is powerful, but it’s not simple. Companies face several big hurdles when they add these services.

Rules for money services are strict and complex. Businesses must follow know-your-customer laws. They have to prevent fraud and money laundering. This requires serious legal work. Getting it wrong can lead to huge fines.

Most companies choose to partner with experts. They use a Banking-as-a-Service provider. This partner handles the banking rules and systems. It lets the brand focus on its customers. Building everything from scratch is expensive and slow.

Handling money brings serious risks. Systems must be secure against hackers. Companies need strong fraud detection. A single data breach can destroy customer trust forever. Security cannot be an afterthought.

Trust is everything in finance. Customers need to feel safe. Companies must be clear about how they use financial data. They should explain things in simple language. Surprises or hidden fees will make people leave.

The technical side must be perfect. The finance features should feel native to the app. They need to load fast and work every time. A clunky payment process hurts the brand more than it helps.

Regulations and compliance.

Money services follow strict rules. Each country has its own laws for identity checks, fraud control, and data use. If a business ignores these, it can face fines or lose customer trust. That’s why most companies work with licensed fintech partners who handle compliance.

Data security and privacy.

Handling payments means handling sensitive data. One leak or breach can cause serious damage. Businesses must protect every transaction and store customer details safely. Encryption and two-factor checks are now standard.

Dependence on partners.

Most companies rely on fintech providers for their finance features. If that provider fails, has downtime, or changes terms, it can hurt the business. Picking the right partner—and having backups—matters a lot.

Customer trust.

People need to feel safe sharing financial details inside non-bank apps. If anything looks unclear or risky, they’ll walk away. Brands must show clear terms and keep users informed at every step.

Scalability issues.

As more users join, systems must stay fast and reliable. Slow or failed payments can damage reputation. Testing for heavy loads and having strong support systems helps prevent this.

Integration complexity.

While APIs make things easier, connecting multiple systems can still be tricky. Bugs or mismatched updates can cause payment errors. Teams need both tech skill and patience to get it right.

These challenges don’t mean companies should avoid embedded finance—but they do need to plan, test, and protect users from day one.

The Future of Embedded Finance: What’s Next?

The embedded finance market is growing fast. It’s not small. It’s getting big—and very soon.

Business-to-business, or B2B, is the next big frontier. Imagine a company buying software. They could get a loan for it right inside the purchasing platform. Or picture a manufacturer. They could secure supply chain financing while ordering parts. This will make business commerce much smoother.

These services will also become more modular. We will see true “Finance-as-a-Service.” Platforms will offer pick-and-choose financial tools. A company could add insurance one month and lending the next. This flexibility will help businesses of all sizes.

Artificial intelligence will make offers incredibly personal. An app won’t just offer a loan. It will offer the right loan at the perfect time. It will know your cash flow and needs. The offers will feel helpful, not random.

Decentralized finance, or DeFi, might become the new backbone. It could provide the “pipes” for global, instant transactions. This would make embedded finance cheaper and more open. It is a complex but promising area.

Soon, embedded finance will be the default. We won’t talk about it as a special feature. It will be a normal part of every digital experience. We will expect to pay, borrow, and invest wherever we are. The companies that build this future will win.

Conclusion 🎯

The change is here. Finance is no longer a separate place you go. It is something that happens where you work, shop, and live. Every company now has a chance to meet customers right where they are.

Embedded finance is changing how money moves. It’s no longer something people handle through banks alone. It now lives inside the apps and services they use every day.

This is not just a trend for tech giants. Small businesses can also join this shift. The tools are becoming more available and affordable. The question is no longer if you should consider it, but how.

For users, this means less hassle. Paying, borrowing, or getting insured takes only a few taps. There’s no need to visit a branch or fill out long forms. It just works—right where they already are.

For businesses, it’s a big opportunity. They can offer extra value without heavy costs or new licenses. A store can act like a lender. A travel site can act like an insurer. A simple app can handle payments for millions of users.

The real power of embedded finance is how it blends into daily life. It makes money services invisible—but always there when needed. That simplicity builds trust and keeps people coming back.

The rise of this trend shows a bigger shift in finance. Banking is becoming something people use, not somewhere they go. And every company, no matter the size, can now play a part in it.

As the next few years unfold, more brands will add financial tools inside their platforms. Those that do it well—putting the user first, staying secure, and keeping things clear—will have a strong edge.

Embedded finance isn’t the future anymore. It’s here, growing fast, and changing how the world handles money—one app at a time.

FAQ 💡

What is a simple definition of embedded finance?

Embedded finance puts financial tools into non-financial apps and websites. It lets you do things like get a loan at checkout or buy insurance inside a travel app. You never have to visit a separate bank site.

What is the difference between embedded finance and Banking-as-a-Service (BaaS)?

Think of BaaS as the pipes and embedded finance as the water coming out of your tap. BaaS is the behind-the-scenes infrastructure that makes it work. Embedded finance is the customer-facing feature, like a “Buy Now, Pay Later” option, that you actually see and use.

How does embedded finance work?

It works through APIs that connect businesses with banks or fintech providers. This lets users make payments, get credit, or access insurance inside a single app.

Why is embedded finance important for businesses?

It helps businesses increase revenue, build loyalty, and offer smoother user experiences without needing to become a bank themselves.

Is embedded finance safe and secure?

Reputable companies partner with regulated banks and fintechs. These partners handle the complex security and compliance. However, you should always check a company’s privacy policy. Make sure you understand how your financial data is used and protected.

What is an example of embedded finance?

Common examples include:

▪️Paying for an Uber ride directly in the app.

▪️Using “Buy Now, Pay Later” when shopping online.

▪️Getting a loan offer inside your Shopify store dashboard.

▪️Adding flight insurance while booking a trip on a travel website.

How can a business start offering embedded finance?

A business can partner with a fintech platform that provides Banking-as-a-Service tools, integrate APIs, and focus on creating a simple, trusted user experience.

References

- https://www.pwc.com/gx/en/issues/technology/tech-translated-embedded-finance.html

- https://www.mckinsey.com/industries/financial-services/our-insights/embedded-finance-the-choices-and-trade-offs-for-us-banks

- https://plaid.com/resources/fintech/what-is-embedded-finance/

- https://www.bcg.com/publications/2025/moving-embedded-finance-from-promise-practice

- https://www.fiserv.com/en/insights/articles-and-blogs/how-embedded-finance-helps.html